- + New Debate

- Debate News

- About

- Debra AI More

frame

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

DebateIsland.com is the largest online debate website globally where anyone can anonymously and easily debate online, casually or formally, while connecting with their friends and others. Users, regardless of debating skill level, can civilly debate just about anything online in a text-based online debate website that supports five easy-to-use and fun debating formats ranging from Casual, to Formalish, to Lincoln-Douglas Formal. In addition, people can improve their debating skills with the help of revolutionary artificial intelligence-powered technology on our debate website. DebateIsland is totally free and provides the best online debate experience of any debate website.

Communities

- 8.3K All Communities

- 254 Technology

- 1.9K Politics

- 679 United States

- 592 Global

- 65 Immigration

- 1.9K Religion

- 230 TV SHOWS

- 60 Movies

- 80 History

- 44 Work Place

- 476 Philosophy

- 411 Science

- 62 Earth Science

- 9 Books

- 101 Economy

- 34 Investments

- 14 Europe

- 10 Tea

- 7 Coffee

- 59 Sports

- 42 Products

- 283 News

- 13 Airplanes

- 33 Cars

- 851 General

- 9 Mafia Games

- 24 Art And Design

- 20 Space

- 50 Military

- 3 Premium Member

DEBATE NEWS

DEBATE NEWS BREAKING NEWS

Hersh Goldberg-Polin's mother speaks out after Hamas releases hostage video of her son

For more than 200 days after Hersh Goldberg-Polin was taken hostage by Hamas on Oct.7, his mother hadn't heard his voice or seen video that proved he was alive. But that changed this week, when Hamas released a propaganda video showing Hersh – an Israeli-American – alive with his left arm amputated. CBS News' Debora Patta sat down with his mother, Rachel Goldberg-Polin, to ask about the "overwhelming and emotional" moment she saw that video and how she hopes all parties involved can reach a...

In this Debate

On wealth and spending habits

Debate Information

One of the most commonly perpetuated notions nowadays is that people on the West are struggling. The wages are allegedly low (despite being the highest in the world), the inequality is allegedly high (despite even the poorest having access to the same means of transportation, quality of food, etc. as everyone else), the jobs are allegedly scarce (despite unemployment rates typically being far below the 10% mark, and often below 5%)... As someone who immigrated to the US from Russia, I can say that an average McDonalds cashier in New York City enjoys far better quality of life than most middle class people in Moscow - yet nobody here seems to appreciate just how well people have it.

However, this is not what I want to discuss here. I want to discuss a different notion related to it: that the reason people are struggling is the system. Someone will say that the rich rob the poor; someone else will say that the regulations prevent the poor from moving up the ranks; others still will say that some people grow up in a social environment not conductive to success, go into bad schools, have terrible parents. etc.

What I personally have observed is that most people have absolutely awful spending habits, something they could easily change at will. More so, most people make terrible financial decisions in life routinely.

(In this particular post I will be using the data and values specific to the US, but all other developed countries I have looked at have the same general patterns as what I describe here.)

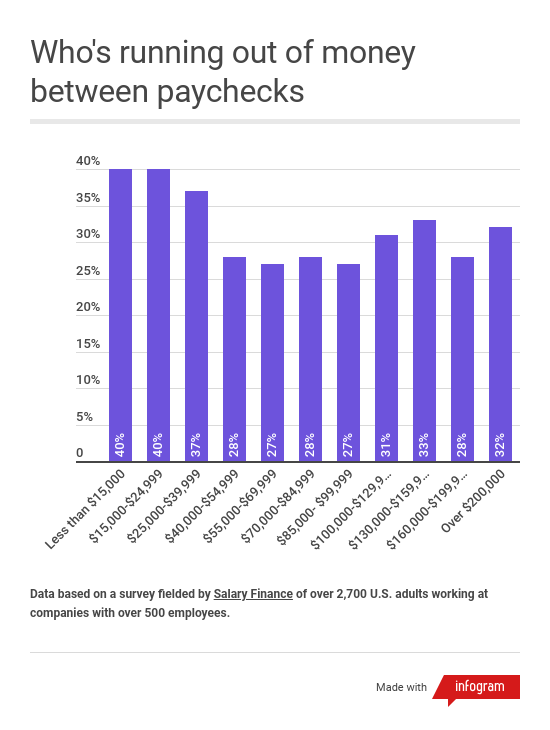

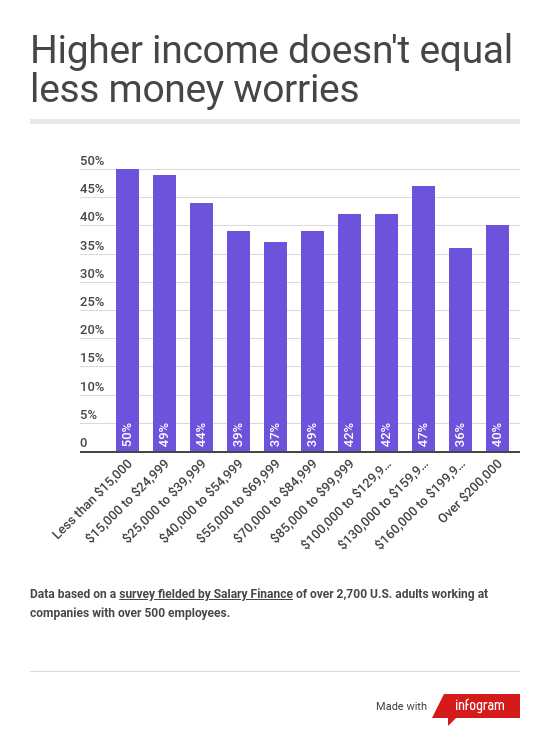

Let us take a look at the results of this survey:

https://www.cnbc.com/2020/02/11/32-percent-of-workers-run-out-of-cash-before-payday.html

The two figures are of interest:

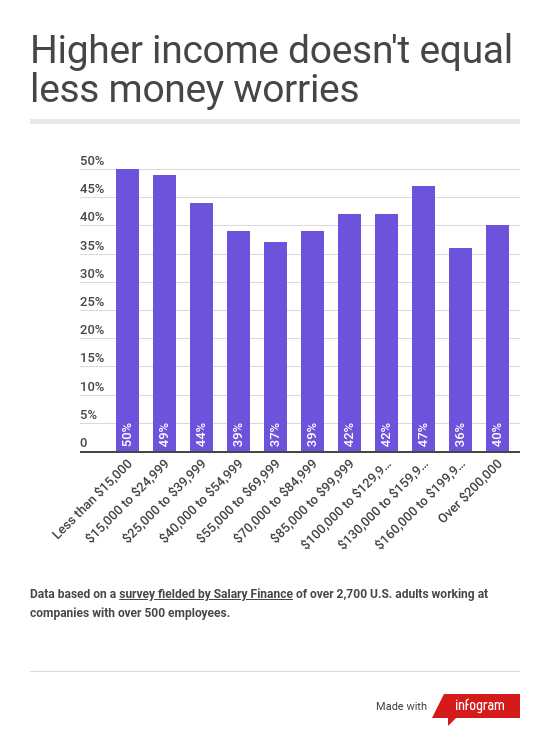

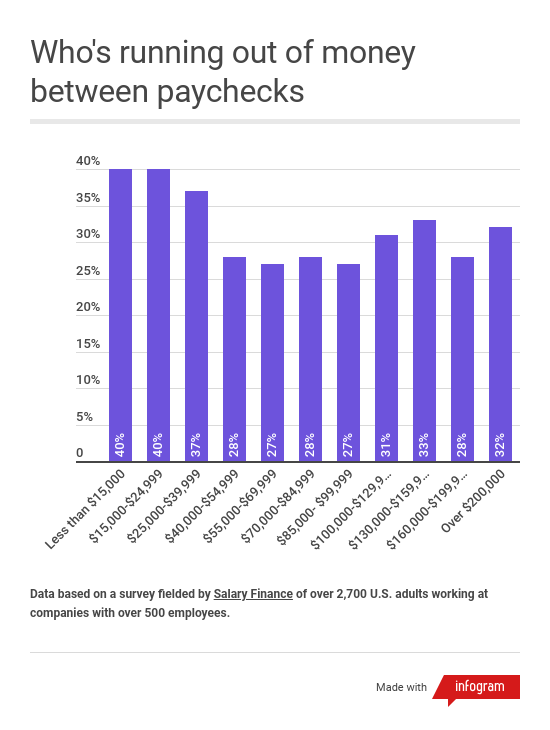

We see that close to 30% of the population runs out of money before their next paycheck, and close to 40% of the population routinely worries about money. What is especially interesting here is how close the fractions are between different income categories. Naturally you would expect people with higher incomes to be less likely to run out of money and worry about money less - but that is not what we see here, and while the poorest people do have this problems more often than the richest people, the difference in rates is quite minor, and are not observed throughout the whole income spectrum.

As we can see, income is not the issue. Inequality is not an issue. Something else is at play here, something far more obvious. The effect that is called lifestyle inflation:

https://www.investopedia.com/terms/l/lifestyle-inflation.asp

The pattern economists have pointed out on numerous occasions is that the ratio of personal spending to personal net income typically stays the same for a given individual and/or household. This means that, for example, if you make $40,000 a year and spend $35,000 a year, then the increase of your net income to $200,000 a year will cause you to spend $175,000 a year - giving you higher surplus, which results in effectively the same spending ability, as, again, you are going to spend that surplus eventually on items with inflated costs.

Now, this would not be a significant problem, if most people spent their money wisely. But that does not seem to be the case. In the US, the median full-time worker income is approximately $48,600:

https://www.bls.gov/news.release/pdf/wkyeng.pdf

Now let us look at some of the things that people buy with that income (unfortunately median costs are hard to obtain, so I will use average ones for some of the items):

You can get a very nice reliable used car for $3,000, you do not need to own your own house and, if you do want one, you can get decent ones in many areas for around $60,000, with condos going even cheaper. Finally, you certainly do not need to eat out, and if you do so, you do not have to spend a few hundred bucks on it. Not if you are struggling.

That is not all of it. While it is true that people also spend a lot of money on college (somewhat hard to assess how much is too much, given that college price strongly correlates with the subsequent income, and people, say, spending $400,000 on a medical school get a very high income and can pay back the debt quickly) and healthcare (a lot of which is typically covered by the employer), you would expect them to spend a lot of money on other useful activities, right? But that, again, is not what we see:

The key takeaways here are:

Now, all this does not in any way imply that the economy in the US (and in other developed countries) is perfect, nor does it necessarily imply that some groups of people are not put into a somewhat disadvantaged position by the system. However, given how much ridiculous spending people do and how easy it would be to tone it down significantly with no noticeable drop (and sometimes even rise) in quality of life, and given how the described problems exist in all worker classes, we have to conclude that the bulk of the problem is in the people, not in the system.

No matter what the system is, if you blow a fortune on useless things, you are going to struggle. In fact, we see again and again people winning hundreds millions in lottery quickly blowing off their fortune and getting into endless debts, quickly ending up in a worse situation than they were before. Even if everyone was a billionaire, the problem would still exist and people would still struggle.

I know it in myself: I bought a car I could not afford and got into a very precarious situation. Then I seriously reconsidered my spending habits and started saving money every way I could, and just a couple of months later I was out of the rut, despite my income and mandatory expenses not changing a bit. If everyone else did the same, I suspect that the bulk of the problem would be resolved, and we would no longer see scary statistics such as "78% Americans live from paycheck to paycheck" and "the average American household is $130,000 in debt".

Do you agree with this reasoning?

However, this is not what I want to discuss here. I want to discuss a different notion related to it: that the reason people are struggling is the system. Someone will say that the rich rob the poor; someone else will say that the regulations prevent the poor from moving up the ranks; others still will say that some people grow up in a social environment not conductive to success, go into bad schools, have terrible parents. etc.

What I personally have observed is that most people have absolutely awful spending habits, something they could easily change at will. More so, most people make terrible financial decisions in life routinely.

(In this particular post I will be using the data and values specific to the US, but all other developed countries I have looked at have the same general patterns as what I describe here.)

Let us take a look at the results of this survey:

https://www.cnbc.com/2020/02/11/32-percent-of-workers-run-out-of-cash-before-payday.html

The two figures are of interest:

We see that close to 30% of the population runs out of money before their next paycheck, and close to 40% of the population routinely worries about money. What is especially interesting here is how close the fractions are between different income categories. Naturally you would expect people with higher incomes to be less likely to run out of money and worry about money less - but that is not what we see here, and while the poorest people do have this problems more often than the richest people, the difference in rates is quite minor, and are not observed throughout the whole income spectrum.

As we can see, income is not the issue. Inequality is not an issue. Something else is at play here, something far more obvious. The effect that is called lifestyle inflation:

https://www.investopedia.com/terms/l/lifestyle-inflation.asp

The pattern economists have pointed out on numerous occasions is that the ratio of personal spending to personal net income typically stays the same for a given individual and/or household. This means that, for example, if you make $40,000 a year and spend $35,000 a year, then the increase of your net income to $200,000 a year will cause you to spend $175,000 a year - giving you higher surplus, which results in effectively the same spending ability, as, again, you are going to spend that surplus eventually on items with inflated costs.

Now, this would not be a significant problem, if most people spent their money wisely. But that does not seem to be the case. In the US, the median full-time worker income is approximately $48,600:

https://www.bls.gov/news.release/pdf/wkyeng.pdf

Now let us look at some of the things that people buy with that income (unfortunately median costs are hard to obtain, so I will use average ones for some of the items):

- Average car price: over $36,000 - https://www.creditdonkey.com/average-car-price.html

- Median house price: $218,000 - https://www.rd.com/advice/average-house-costs-in-each-state/

- Average food household yearly spending: $7,200 ($3,150 on dining outside home) - https://www.thesimpledollar.com/save-money/lessons-from-the-average-americans-food-expense/; each individual adult American spends $1,200 on fast food - https://www.smartfem.com/health/americans-spend-1200-a-year-on-fast-food/

You can get a very nice reliable used car for $3,000, you do not need to own your own house and, if you do want one, you can get decent ones in many areas for around $60,000, with condos going even cheaper. Finally, you certainly do not need to eat out, and if you do so, you do not have to spend a few hundred bucks on it. Not if you are struggling.

That is not all of it. While it is true that people also spend a lot of money on college (somewhat hard to assess how much is too much, given that college price strongly correlates with the subsequent income, and people, say, spending $400,000 on a medical school get a very high income and can pay back the debt quickly) and healthcare (a lot of which is typically covered by the employer), you would expect them to spend a lot of money on other useful activities, right? But that, again, is not what we see:

- Annual gym membership and accessories spending: less than $1,000 - https://us.myprotein.com/thezone/training/much-americans-spend-health-fitness-survey-results-revealed/

- Annual book spending: less than $30!!! - https://www.statista.com/statistics/191043/us-consumer-spending-on-books-since-2002/ - with almost a quarter Americans having not read a single book in the past year - https://www.cnbc.com/2019/01/29/24-percent-of-american-adults-havent-read-a-book-in-the-past-year--heres-why-.html; in comparison, average American spends over 4 times this much annually on video games - https://www.statista.com/chart/9838/consumer-spending-on-video-games/

The key takeaways here are:

- People severely overspend money on things they do not need.

- People spend orders of magnitude less on things they do need.

- People do not change their spending-to-income ratio and have approximately the same economical situation regardless of their income.

- People take far more debt than they need (credit cars, auto loans, mortgages, etc.) and end up paying fortunes in interest.

- People invest money into useless things (countless college degrees that offer few employment opportunities, various beauty salons, startups that flop, etc.), and do not invest enough money into things that have proven to be effective money-wise (index funds, IRA accounts, business ideas, etc.).

- People spend too much time relaxing at home watching Netflix / playing video games, or going to expensive parties, instead of working on their skills or doing more healthy hobbies, such as going to parks, meeting with professional interest groups, doing sports with friends.

- People are willing to pay for their kids' private tutoring over $1,000 an hour sometimes. While it is possible that there are tutors actually worth this much, I seriously doubt there are many of them - yet they seem to pay this much to almost anyone with any credentials whatsoever.

- People buy old wine bottles for hundreds dollars and blow thousands at restaurants, including thousands given waiters in tips; no meal can possibly cost this much.

- People buy fancy dresses costing dozens thousands dollars, which look very similar to what you can get on Amazon for a few dozen bucks - they pay for the brand which, ultimately, no one, except them, cares about.

Now, all this does not in any way imply that the economy in the US (and in other developed countries) is perfect, nor does it necessarily imply that some groups of people are not put into a somewhat disadvantaged position by the system. However, given how much ridiculous spending people do and how easy it would be to tone it down significantly with no noticeable drop (and sometimes even rise) in quality of life, and given how the described problems exist in all worker classes, we have to conclude that the bulk of the problem is in the people, not in the system.

No matter what the system is, if you blow a fortune on useless things, you are going to struggle. In fact, we see again and again people winning hundreds millions in lottery quickly blowing off their fortune and getting into endless debts, quickly ending up in a worse situation than they were before. Even if everyone was a billionaire, the problem would still exist and people would still struggle.

I know it in myself: I bought a car I could not afford and got into a very precarious situation. Then I seriously reconsidered my spending habits and started saving money every way I could, and just a couple of months later I was out of the rut, despite my income and mandatory expenses not changing a bit. If everyone else did the same, I suspect that the bulk of the problem would be resolved, and we would no longer see scary statistics such as "78% Americans live from paycheck to paycheck" and "the average American household is $130,000 in debt".

Do you agree with this reasoning?

Post Argument Now Debate Details +

Arguments

Put simply, it seems that your argument is "The reason that many people in the west are struggling financially is because they over spend on consumer goods and non-essential products which affects individuals at all economic strata"

The evidence you provide seems to indicate that there is almost no disparity between those struggling at the bottom and those struggling at the top, however I would propose that this information is somewhat incomplete, because the vast majority of the wealth is not in the hands of those consumers, but rather in the hands of the ultra rich, who may not be receiving fair representation on the graphs you provide because they are based on occupational income and are so high and of so few members that they would be statistically insignificant in the data should there be any disparity.

From this I would ask, is it possible that the consumers are struggling because they lack the resource availability that their wealthy counterparts have, such as land, manufacturing, capital assets, and financial assets?

The US economy is about 70% consumer spending. If what you are saying is true, and a high number of people will spend a fixed proportion of their income rather than a fixed amount, It would imply that the size of the economy would be based around the amount of resources available to be moved at any given time, because any employers could pay their workers an amount that is a proportion of the companies profit, so if the company can move more resources for the same amount of labor, the value of that labor increases. If a company could move way more twice the amount of resources as it currently does, then it would need to be offset with twice as much consumption, thus everyone's salary should double for the same amount of labor. This can be achieved through technological means.

However, what we see in the real world is that employers instead pay their employees the same amount and take an increased profit, which has lead to great he wealth inequality on a global scale. Could it then be concluded that economic struggling is based on the disparity between the amount of goods that can be moved and the value of the labor that produces those goods?

Much of consumer spending is not based on earned wealth but rather on credit. This is especially true of the lower and middle classes, which spend the most on credit and run up the highest debts. This means that they will end up paying a higher amount for each purchase if they are not able to pay off their bills. Taking the premise in the above counter question, it could be concluded that if they were paid more they may be able to pay off their debts, since their labor should be worth more. However, those who have the option to spend more than they already have through credit may spend beyond their means anyways.

Could it then be argued, that it is credit which is causing people to struggle financially be enabling individuals to spend beyond their means and over spend?

I would say that I mostly agree with your argument, although I think there might be a little bit more to it than just human nature being a detriment to itself in a system deliberately intended to exploit those weaknesses.

Stars formed, planets coalesced, and on at least one of them life took root.

Through a long process of evolution this life developed into the human race.

Humans conquered fire, built complex societies and advanced technology .

All of that so we can argue about nothing.

Considerate: 86%

Substantial: 100%

Spelling & Grammar: 98%

Sentiment: Positive

Avg. Grade Level: 13.16

Sources: 0

Relevant (Beta): 100%

Learn More About Debra

It is a valid question, but I am not sure how it stands up to the evidence suggesting that the fraction of the population struggling financially does not depend on the personal income for the vast majority of the population. Even assuming the consumers lack the resource availability the richest people have access to, someone earning $200,000 a year is still going to be much better off than someone earning $20,000 a year; that this does not seem to be the case indicates that the problem lays somewhere else than income.

For that matter, I cannot think of any resources that the ultra-rich have access to and, say, the rich do not. Someone earning, say, $200,000 a year with an effort can become a millionaire within less than a decade, and a millionaire can buy an item from almost any meaningful category, short of exquisite categories such as personal jets.

I see your point with regards to doubling people's salary - however, this is an argument I have always found somewhat strange. The idea that boosting consumer purchasing power ultimately benefits companies which now can offer more goods and services to people assumes that the profit from each sold item remains the same - but is it really the case?

Let us consider a hypothetical economy which features 1000 consumers and 10 companies. Each consumer's income is $100,000 a year, and each of the companies produces cars and sells each car for $50,000. Let us assume that each consumer spends 10% of their income on cars, meaning each consumer buys a new car each 5 years. The companies accordingly produce 200 cars a year; perfect supply/demand balance.

Now, suppose the consumer's income increases by a factor of two and now is $200,000 a year (no inflation). Now each consumer can buy a new car each 2.5 years. At the first glance, the companies should now be able to sell 400 cars a year, for double the profit, right? Well, not quite.

Think about where these consumers work... They work, among other entities, at those very 10 companies! So those people who work at these companies now make $200,000 a year; these companies' labor expenses have increased along with people's purchasing power (where else can increased purchasing power come from?). Moreover, to sell 400 cars a year, instead of 200, they now have to hire twice as many employees; so the actual labor costs have now quadrupled, while the revenue from car sales has only doubled. Considering that labor costs tend to be the biggest source of expenses in the corporate world, it means that these companies are going to be at a loss.

See, it is impossible to increase people's purchasing power magically without decreasing the companies' production power. The issue with doing it despite this notion is obvious: the supply/demand balance is upset, and so there are going to be shortages, as the demand has increased, while the supply has decreased.

As such, I do not really buy the idea that putting more money in people's hands is going to spur the economical growth and increase companies' profits. Now, I do think it is possible if the resource distribution is skewed to begin with, which tends to be the case in corrupt state-controlled market economies - but on a relatively free market it does not seem to have a chance to work.

Taking too much credit certainly causes financial problems in many people's lives; Dave Ramsey's show features regular phone calls with people describing how getting deep in debt ruined their lives. But, again, taking too much credit is a choice; in principle, it is possible to live without any credit cards and loans in the US, even on a minimum wage (I lived on a tiny fraction of a minimum wage in Virginia for a month once, although I do not recommend it). And people who have $100k+ incomes certainly can do away with no credit whatsoever and still enjoy a lavish lifestyle.

It seems to me that a very large part of the equation is people's life choices. It could be argued that the market players have learned to exploit people's psychological weaknesses well, and that is true - but that does not excuse poor financial choices. I personally have always believed that, regardless of any external conditioning, at the end of the day your life is in your hands, and you always have the power to resist any temptations you might have. In fact, resisting them is very easy if you truly make that choice and commit to it; it is very hard only if you keep struggling with yourself internally, trying to find a compromise between two opposing desires: to be well off in the long run and to get a short-term emotional satisfaction. Simply deciding to always make a decision that benefits you in the long run solves the problem instantly - and also frees up a lot of energy in you, as you no longer have to ruminate over difficult choices and can make snappy decisions and move on.

As much as I do not want to admit it as an intellectual type of a person, the vast majority of problems in human lives come from thinking about things too much. Thinking a lot is good, but this thinking has to be directed at the right things. Thinking about complicated mechanisms affecting the world is healthy; thinking about whether to buy this juicy, but unhealthy, snack or not, on the other hand, is very unhealthy. Mental discipline (that is being able to direct your thoughts in a way that serves you) is extremely important, and unfortunately it is rarely, if ever, taught at schools or in families.

Considerate: 91%

Substantial: 99%

Spelling & Grammar: 96%

Sentiment: Positive

Avg. Grade Level: 12.14

Sources: 0

Entity Sentiment Detection: richest people companies produces cars ultra-rich have access personal income

Relevant (Beta): 56%

Learn More About Debra

I think the way you are doing your math isn't in line with the argument I am making. It should look something more like this, considering the factor that you didn't account for, which I am just going to call "energy price" by assuming that raw materials are of unlimited supply. I am not arguing that simply increasing consumer paycheck is going to make them spend more exactly, I am saying that the profits will go into the hands of the owners instead of the consumers.

Let's say that each car costs $20,000 for the company to produce, and they sell them at $50,000 with about $20,000 going to employee labor, that a decrease in energy cost will not actually decrease the value of the car, so if now the car can be produced for $10,000 it will still be sold for $50,000 and the owner will collect the difference, meaning that they will now be able to buy more cars themselves, effectively extracting free labor from the employees because now the value of their labor went up without their pay going up.

similarly, if the energy price remains fixed but some technological advancement allows the company to produce twice as many cars without hiring more employees, now the company can sell twice as many cars, but there will be no one to buy them without increasing the employee's salary. So, by not paying their employees more, they can not buy as much, and thus they can not sell as much, thus they can not maximize profit. However there is an incentive not to do so, because by minimizing production costs they can make themselves more competitive in the market, so it is unlikely that any company would do this.

As for people's choices being what ultimately determines their status, this is a deep rabbit hole that I don't know has a bottom. Do people really have choice if the options they have are provided to them? This could get very philosophical very fast. Personally, I don't think that people truly have free will or that anyone is completely in control of their own choices. Our modern world is very much built around exploitation of people's natural instincts and tendencies, which are in no way our choice but rather are the result of evolution over millennia.

Stars formed, planets coalesced, and on at least one of them life took root.

Through a long process of evolution this life developed into the human race.

Humans conquered fire, built complex societies and advanced technology .

All of that so we can argue about nothing.

Considerate: 88%

Substantial: 100%

Spelling & Grammar: 98%

Sentiment: Positive

Avg. Grade Level: 12.86

Sources: 0

Relevant (Beta): 99%

Learn More About Debra

I am not sure I understand your argument. I think you will agree that just one company choosing to pay its employees more will not change anything, and for a significant increase of collective purchasing power, all or, at least, a large fraction of the employers have to raise their employees' salary. Assuming it can somehow happen naturally, I still do not see any benefits of this.

Larger salaries simply mean that people are going to have more currency on their hands. However, they will work the same hours, do the same jobs, etc. The economical output does not change, and nor does the amount of goods and services people can purchase.

So people have more currency on their hands, while the market looks essentially the same. The obvious outcome of this is price inflation that will mostly eat up the benefits. It is essentially just a wealth redistribution scheme. And while such redistribution theoretically can benefit the population, I fail to see how it can possibly increase the economical output and what benefits companies can have from it.

The average person is going to work 40-hour weeks; you can try to increase workers' productivity by, perhaps, training them better or implementing new technology - but you are not going to increase their productivity significantly by just giving them a larger share of your profits. Perhaps paying someone $200,000 instead of $50,000 can increase their eagerness to work hard some, but I am not familiar with any research suggesting that the productivity increase is comparable with the salary increase.

Well, we have to draw the line between "It was their choice" and "They were just following their instincts" somewhere. On a very fundamental level one could say that, ultimately, all our choices are predetermined: we have absolutely no free will, and under given circumstances we always will take a specific set of actions. But if that is our interpretation of people's decision-making, then we are all essentially robots, responsible for absolutely nothing: after all, all we do is mindlessly react to the external circumstances, so what is the point thinking about any choices at all? Nothing is right or wrong then. If someone, for example, kills a million people with a nuclear strike, then they were just following their "programming", so who can blame them for anything? Let us just go back to animal kingdom anarchy, where everyone is doing whatever they feel like at the moment with no considerations for anything or anyone else.

From a practical standpoint, however, it is necessary to determine some threshold beyond which the individual's choices are free. I personally see this threshold exactly where coercion begins and voluntarism ends: the moment someone threatens you with violence to your property (including your body and its freedom of movement) if you do or do not do something, your actions are no longer yours. But until that point, ultimately, you are free to act however you want. If you want to, you can act against your emotions, against your instincts even. You can overcome any addictions or temptations instantly by making a conscious and firm choice. Not saying it is easy; it can be brutally hard, to the point where some people would rather die than do it and succeed. But it is ultimately a choice. It is no longer really a choice when you are coerced, however; that is, you still can make a choice, but it is no longer purely your choice, as the external conditions have been introduced by a conscious agent that deprived you of the options you had before.

I realise that this is a somewhat subjective stance, but I do not see a better point to put the threshold at than this. Some people employ a more collectivist approach and draw the line where the collective good becomes threatened, but this approach has led to spectacularly terrible results in human history, both on the scale of societies and smaller communities.

Considerate: 88%

Substantial: 100%

Spelling & Grammar: 97%

Sentiment: Positive

Avg. Grade Level: 12.98

Sources: 0

Relevant (Beta): 98%

Learn More About Debra

Lets just play with the numbers a little, lets say that the fertilizer is made more effective due to farming technique. Now we can produce 3 food for 1 unit of fertilizer. Now the farmer can sell 5 units of fertilizer and produce 15 food. However, lets say he gets greedy and still only pays his workers 4/5 of what the food is worth. now he will get to eat like a king but his employees will starve even though there is more than enough to go around. He will make a surplus of 6 units of food. From an industrialization standpoint, he might fire one worker only buy 4 units of fertilizer and only produce 12 food, however this doesn't mean that he still has to pay more to his employees, because they are doing the same work. Thus excess value can be extracted from the labor which doesn't have to end up in the hands of the employees.

Stars formed, planets coalesced, and on at least one of them life took root.

Through a long process of evolution this life developed into the human race.

Humans conquered fire, built complex societies and advanced technology .

All of that so we can argue about nothing.

Considerate: 88%

Substantial: 100%

Spelling & Grammar: 98%

Sentiment: Neutral

Avg. Grade Level: 9.38

Sources: 0

Entity Sentiment Detection: case lets land owner unit of fertilizer enough food

Relevant (Beta): 98%

Learn More About Debra

I see your point, but I think there are several flaws with this argument that undermine it significantly.

First, the employer himself can only consume so much. Let us say in your example everyone only eats tomatoes (we will assume that tomatoes alone provide all the required nutrition for a human being). The employer has little to gain by leaving himself, say, 70,000 tomatoes a year, as he will never be able to consume so much and will just waste good tomatoes. It makes more sense for him to give more tomatoes to his employees in order to make them happier and want to work harder in the light of further possible raises.

Now, you could object to this with the notion that in a real economy we real deal with the money, a universal currency that can be used to buy anything - and any amount of money can be consumed, in principle, by a single person. However, it does not change the fact that currency is always attached to hard assets; it does not exist in vacuum. If the economy produces a surplus of goods, then that surplus is going to be wasted, and the companies producing it will lose a lot of potential profit.

For this reason, when technology increases productivity of employees, generally it is not the amount of goods and services produced that increases, but their quality does. There are only so many cars you can produce before everyone who could afford one has bought one, two or three and does not need more cars; the way to gain more profit then is to improve the cars and sell newer and better versions of them. So we are back at the square one: the quality of production has increased, but the actual amount has not.

Suppose a given automaker sold 10 million cars last year; well, this automaker generally will expect to sell 10 million cars this year as well (possibly adjusted for the population size increase), at a similar inflation-adjusted price, but of higher quality. So even if the employees' inflation-adjusted income has not changed, the actual value they get when they "consume" that income will be higher than before, hence they end up better off.

Second, you are assuming that the employer can just be greedy and get away with it - but being overly greedy can be fatal on a real competitive market. In a real economy there will be more than one farmer. Imagine that one farmer is greedy and still pays his workers 4/5 of what the food is worth on the market, while another farmer is pragmatic and pays his workers exactly how much the market evaluates the food, and another still is generous and pays his workers 6/5 of that. Now all the best workers whose skills are in demand and who can choose between different job offers, obviously, will try to get a job at the last farmer's place - that farmer though cannot sustain his model, as he overpays his workers and cannot earn any significant profit; he will either go out of business or lower the worker pay. In any case, you can see that, at the very least, the second farmer will vastly outcompete the first one, who will have to rely on workers who cannot find jobs anywhere else and, hence, statistically are going to have lower skills. The second farmer will be better off than the first one, and if the first farmer is smart, he will figure it out eventually and raise the offered pay.

Now, there is a conspiracy theory (especially popular in socialist circles) according to which all major employers somehow bargain with each other behind the closed doors and collectively lower wages to all workers in order to secure larger profit... I will not consider it seriously and just say that, as with any other conspiracy theory, the model crumbles as soon as a few whistleblowers decide to speak up, or as soon as just one company management refuses to be a part of the scheme.

Companies can influence the government to create market barriers and other regulations that allow them to get away with underpaying their workers though, which certainly does happen in the US - but the reverse is also true, and worker unions, consumer protection agencies and other powerful entities do the same kind of lobbying as well. Perhaps there is a significant net negative impact on workers' salaries as a result of this, but I have never seen any evidence suggesting that this is the case.

In any case, I do not see what companies could possibly gain solely from increase of consumer purchasing power. If the increase coincides with other favorable phenomena, such as a boost of production efficiency as a result of technological evolution or improvements in the governmental policies, then, of course, the companies are going to be better off - but in that case the increase of consumer purchasing power is just a consequence of more fundamental changes, and is not in itself a force for change.

Considerate: 89%

Substantial: 99%

Spelling & Grammar: 97%

Sentiment: Positive

Avg. Grade Level: 12.68

Sources: 0

Relevant (Beta): 92%

Learn More About Debra

The employer can be greedy and get away with it, although it depends on the type of product or service they are producing more than anything else. For example, if they are a bank, insurance company, or anything in the FIRE sector really, they don't need a lot of people to run things, they can make a lot of profit with relatively little overhead cost. This is of course a totally different animal when compared to production, and I think I would have been wiser to have focused on them although it is harder to illustrate the point.

I think it is obvious what a business has to gain by producing more product, namely they can make a higher profit if they can sell more stuff. However they can't sell more stuff if the consumers don't have more money to buy stuff with, because those funds are locked up in the hands of just a few very wealthy individuals. If the health of the economy is based on how much and how fast money is changing hands, then rich people who own more than they could ever need and buy as much as they want without barely making a dent in the economy is bad for the economy.

Stars formed, planets coalesced, and on at least one of them life took root.

Through a long process of evolution this life developed into the human race.

Humans conquered fire, built complex societies and advanced technology .

All of that so we can argue about nothing.

Considerate: 74%

Substantial: 100%

Spelling & Grammar: 98%

Sentiment: Positive

Avg. Grade Level: 12.48

Sources: 0

Entity Sentiment Detection: company profits Minimum wage cost of their labor higher skill worker

Relevant (Beta): 100%

Learn More About Debra

Well, first of all, I disagree that the minimum wage is not enough to make a living, given how I have lived for over 4 years spending far less than the minimum wage on mandatory expenses (I was terrible with money at the time and spent it on a lot of unnecessary things, but that was my own problem). You can also look at the graphs in the original post, to see that people earning the minimum or close to the minimum wage do not struggle much more than those earning a very high wage.

Aside from that, while it is true that the employees' wages do not scale the same way their productivity does (if it did, then there would be absolutely no reason for any business to discriminate between different employees, as each employee would produce the same amount of profit for the company - job interviews, for example, would not be needed and would only waste the company resources), they do scale quite significantly.

Compare two job candidates: one has a projected productivity of $30 an hour and asks for a $20 an hour salary, and another has a projected productivity of $50 an hour and asks for a $30 an hour salary. The second candidate is a better deal for the company. Similarly, the first candidate may get a higher pay offer in case technological development boosts their productivity, "turning" them into the second candidate.

It is virtually impossible for a company to get enough employees by keeping the same wage offerings despite increased productivity, while its competitors adjust their wage offerings accordingly. Unless all companies somehow conspire together and collectively lower wages (which never happens in practice), this is not going to be viable.

When a company does not need a lot of people to run things, then it means that labor costs are going to be a fairly insignificant part of its expenses, hence it makes sense for it to spend a little bit extra to hire the best employees it can possibly find. If a bank has 100 employees, but racks up $1,000,000,000 yearly revenue, then paying the employees $200,000 a year versus $100,000 a year each is not going to make a dramatic difference for the company's expenses, while packing the company with 100 top-level professionals versus 100 fresh graduates is likely to improve the bank performance considerably.

You also need to take into account the degree of competition in the bank industry; to secure a position there, you better have a truly stellar business idea and extreme determination, or you will be wiped out instantly by multi-trillion banks that eat hundreds newbie competitors each year for breakfast.

In order for people to have more money, businesses have to pay them more (or the money must be extracted from businesses in some other way, leading to the same outcome). Your idea seems to come down to businesses giving people money so they then can buy their products with that money - but that does not make a lot of sense, does it? You do not make any profit by paying someone $50,000 extra, so you can sell them a $50,000 car next year; you just lose money by spending it on something that you essentially give away for free.

It is no different if we consider instead private rich individuals taking less money to themselves and leaving more to the company, so it can pay higher wages to the employees. First the difference is going to be negligible in most cases, since company owners typically have fairly small net wealth compared to what the company is worth (for example, Steve Jobs' net worth at the moment of his death was $10.2b, while Apple was worth ~$300b at that time). And second, since the richest individuals keep most of their money in stocks, investments, real estate, etc., that is, ultimately, in other businesses - it again effectively comes down to businesses paying people higher wages, so they could buy more products and services, which defeats the whole purpose of those businesses' existence.

I think the desire for the workers to be better off is a noble one, but I do not think proposals of this kind, coming down to simple redistribution of wealth (forced or voluntary), actually address the problem. For the workers to be better off, the whole economy should be better off, and that is achieved by means of economical growth and technological evolution, not by changes in the corporate culture (which also can help, but they are unlikely to be the primary driver of betterment of the economy). In fact, we see that performance of businesses in very different cultures and often quite different legal systems, all other things equal, tends to be strikingly similar: businesses in Japan exhibit quite similar efficiency to businesses in the US, for example, even though Japanese corporate culture is much more egalitarian.

Considerate: 88%

Substantial: 100%

Spelling & Grammar: 97%

Sentiment: Positive

Avg. Grade Level: 13.1

Sources: 0

Relevant (Beta): 88%

Learn More About Debra